Looking for an open house this weekend? Text openhouse to 97000 or call me at 951-259-0764.

#openhouse #realestate #morenovalley

Find Moreno Valley homes for sale. Moreno Valley homes for sale includes homes in Moreno Valley, Rancho Belago and, of course most of Riverside County. Thinking of selling? contact me at 951-259-0764 or billtsellshomes@gmail.com for your no obligation property valuation.

Saturday, August 30, 2014

Friday, August 22, 2014

Moreno Valley Homes for Sale - Statistics from Inland Valley Association of Realtors

Check out this years numbers. Let me know what you think at 951-259-0764 or billtsellshomes@gmail.com

#realestate #morenovalley #homesforsale

#realestate #morenovalley #homesforsale

Thursday, August 21, 2014

Moreno Valley Homes for Sale - Singles: Why We're Buying Now

Moreno Valley Homes for Sale -

Singles: Why We're Buying Now

Daily Real Estate News |

Thursday, August 21, 2014

Seventy-five percent of single home

owners ages 25 to 50 say home ownership is important to them, according

to a new Century 21 survey.These are the top three reasons single home owners say they decided to buy: They viewed home ownership as an investment in their financial future; they were tired of paying rent; and they thought it was the right time to purchase a home.

“We are in the midst of a shift in the home-buying population,” says Rick Davidson, president and chief executive officer of Century 21 Real Estate LLC. “This survey shows that home ownership is a major life decision for singles and that it is just as important a part of the American Dream for them as it is for married couples.”

Nearly one-third of all real estate purchases in 2013 were made by single home buyers, according to data from the National Association of REALTORS®.

But single home buyers say it wasn’t easy to achieve home ownership because many were intimidated by the home-buying process, and they had to make several sacrifices in order to buy a home.

Nearly two-thirds of single home owners say they overcame a roadblock to buy their home. The most intimidating parts of the home-buying process, they say, included making an offer and negotiating a price (38%); obtaining a mortgage (36%); moving (31%); closing (30%); and searching for and locating a home (25%).

Singles also say they had to make several lifestyle sacrifices: 60 percent say they had to dine out less to purchase a home, and half say they had to cut back on entertainment. Fifty-one percent say they had to spend less on vacations.

What were their most important considerations in buying a home? Single home owners rated space and square footage (59%); the yard (57%); and proximity to work or school (47%) as the most important criteria in their house hunt, according to the Century 21 survey. Good cell service and proximity to public transportation tended to be more important to single home owners 25 to 35 years old than those 36 to 50 years old.

The younger set was also more likely to say they searched for real estate on their mobile devices.

#realestate #morenovalley #morenovalleyhomesforsale #riverside

Lending standards loosen up

What do you think about this? Let me know at 951-259-0764 or billtsellshomes@gmail.com

#realestate #morenovalley #homesforsale

Getting

a mortgage these days is obviously not as easy as it was during the

housing boom, when pretty much anyone could get a loan.

But after years of tightening, it seems like the standards are loosening up a bit.

"We are seeing underwriters have a little more flexibility with some common-sense issues," Grabel says. "That's not a suggestion we are going back to the old days."

Standards have loosened mostly for larger loans, or jumbo loans, because they are not the types of loans that get sold to Fannie Mae and Freddie Mac. The institutions have their own guidelines and lenders must follow them if they want to sell the loans after they issue them.

"Mel Watt reversed course for the first time in many years to say we have to loosen the current lending standards," Hsieh says.

Some lenders also are allowing lower credit scores on FHA loans. Many lenders required borrowers to have a credit score of at least 640 for an FHA loan.

But after years of tightening, it seems like the standards are loosening up a bit.

"We are seeing underwriters have a little more flexibility with some common-sense issues," Grabel says. "That's not a suggestion we are going back to the old days."

Standards have loosened mostly for larger loans, or jumbo loans, because they are not the types of loans that get sold to Fannie Mae and Freddie Mac. The institutions have their own guidelines and lenders must follow them if they want to sell the loans after they issue them.

Still gotta be able to fog a mirror

Mel Watt, the new head of the Federal Housing Finance Agency, recently said his office will change some of the guidelines to allow lending to borrowers with slightly lower credit scores. The FHFA oversees Fannie and Freddie."Mel Watt reversed course for the first time in many years to say we have to loosen the current lending standards," Hsieh says.

Some lenders also are allowing lower credit scores on FHA loans. Many lenders required borrowers to have a credit score of at least 640 for an FHA loan.

Wednesday, August 20, 2014

Moreno Valley Homes for Sale - Affordability Approaches Pre-2004 Norm as Prices Firm

Call me and let's talk about what this might mean for you! 951-259-0764

Housing affordability dipped slightly in the second quarter of 2014 as several markets saw a firming of home prices, according to the NAHB/Wells Fargo Housing Opportunity Index (HOI). Nationwide, the second quarter HOI was 62.6—i.e., 62.6 percent of new and existing homes sold during the quarter were affordable to a family earning the U.S. median income of $63,900—down about three percentage points from the first quarter reading of 65.5.

Among individual metros, Youngstown-Warren-Boardman, Ohio-Pa. claimed the title of the nation’s most affordable major housing market, as 90.4 percent of all new and existing homes sold in this year’s second quarter were affordable to a family earning the area’s median income of $52,700. Cumberland, Md.-W.Va. was the most affordable smaller market, with 97.2 percent of homes sold affordable to a family earning the area median income of $54,100.

Other major markets at the top of the affordability chart were Indianapolis-Carmel, Ind.; Syracuse, N.Y.; Harrisburg-Carlisle, Pa.; and Scranton-Wilkes-Barre, Pa. Smaller markets joining Cumberland at the top of the affordability chart were Kokomo, Ind.; Davenport-Moline-Rock Island, Iowa-Ill.; Battle Creek, Mich.; and Lima, Ohio.

For a seventh consecutive quarter, San Francisco-San Mateo-Redwood City, Calif. was the nation’s least affordable major market, with only 11.1 percent of homes sold in the second quarter affordable to a family earning the area’s median income of $100,400. Other major metros at the bottom of the affordability chart were Santa Ana-Anaheim-Irvine, Calif.; Los Angeles-Long Beach-Glendale, Calif.; San Jose-Sunnyvale-Santa Clara, Calif.; and New York-White Plains-Wayne, N.Y.-N.J.

All five of the nation’s least affordable small housing markets were located in California: Santa Cruz-Watsonville, Napa, Salinas, Santa Rosa-Petaluma, and San Luis Obispo-Paso Robles.

Tuesday, August 19, 2014

MORENO VALLEY HOMES FOR SALE: Dwindling Competition for Home Buyers?

Daily Real Estate News |

Tuesday, August 19, 2014

All-cash sales in real estate purchases dropped from 42 percent in the first quarter to 37.9 percent in the second quarter of this year, according to RealtyTrac’s second-quarter 2014 U.S. Institutional Investor & Cash Sales Report. Still, cash sales remain above year-ago levels, when they were at 35.7 percent.

The share of sales from institutional investors — those who purchase at least 10 properties in a calendar year — also dropped in the second quarter to 4.7 percent. That marks the lowest level since the first quarter of 2012, when institutional investors represented 4.6 percent of all sales, RealtyTrac reports.

“The flurry of purchases by institutional investors and other cash buyers that kicked off two years ago when U.S. home prices hit bottom is finally showing signs of subsiding,” says Daren Blomquist, vice president of RealtyTrac. “Over the past 10 quarters, cash sales have accounted for 39 percent of all home sales on average, and institutional investor purchases have accounted for 5.3 percent of all home sales on average. Prior to that, from 2001 to 2011, the average quarterly cash share was 30 percent, and the average quarterly institutional investor share was 2.6 percent. This is a classic good news/bad news scenario for the housing market.”

The good news is that having fewer cash buyers in the market should “help loosen up inventory of homes for sale and reduce competitive bidding, giving first-time home buyers and other non-cash buyers more opportunities,” Blomquist says. “The bad news is that some of those first-time home buyers and other non-cash buyers may already be priced out of the market thanks to the rapid run-up in home prices over the past two years in many areas.”

In the second quarter, cash sales accounted for 67 percent of purchases of homes selling for $100,000 or less, according to RealtyTrac.

Call me at 951-259-0764 for more information.

Moreno Valley Homes for Sale and 6 Things NOT To Do

6 Things NOT To Do When Buying for the First Time

From the mortgage application to final closing, there are so many steps to the real estate buying process that it can be easy to make mistakes or errors. Because I work with dozens of first-time homebuyers and the Moreno Valley real estate market I want to be sure that my future clients understand the process as well as some of the most common mistakes the first time homebuyers make. It can be genuinely heartbreaking to get to the closing table and realize that the buyers made some financial error a week or two prior which has now caused the real estate deal to fall apart. This can be devastating and emotionally heartbreaking.Here are six things not to do during the home buying process.

#1 – Applying for a mortgage and then apply for other loans and lines of credit.

Once you apply for a mortgage you should not try to take out any more

credit or loans until the deal closes. Any major financial moves after

you have been approved for a home loan can seriously affect your

mortgage rate or even the ability to get the loan at all. It can be very

easy for first-time home buyers to get wrapped up in owning a new home.

They often times go out and start applying for credit at furniture

stores or even max out their credit cards on new appliances and

furnishings. The problem with this is that by the time final financing

goes through you may have a different credit score affecting your

interest rate or you may not even be able to afford the amount that you

originally started with. It’s best to hold off on all major financing

decisions until after you own the home.#2 – Quitting your job or losing it all together.

#3 – Buying anything major, even if not on credit.

As I said before, applying for any other loans or credit is not a good idea but even if you have the cash it’s not wise to make large purchases before your transaction has closed. Even if you have $10,000 in the bank but during the time that you apply for a home loan and the closing you use that money to purchase a vehicle, the bank now sees that you have $10,000 less in assets and this may negatively affect your interest rate. You probably will not lose the home loan altogether but it could affect how much you pay at closing and how much your interest rate is over time.#4 – Not understanding property taxes, homeowners insurance and the general costs of owning a home.

Too often many home buyers don’t understand that it’s more than simply a mortgage payment when you become a homeowner. Not only will your monthly payment include your principal mortgage interest you may also include property tax and homeowners insurance in that monthly payment. Many first-time buyers find that this is a very easy way to keep everything in one payment. However, this could add several hundred dollars to your monthly payment so you’ll need to consider that when budgeting. Plus, being a homeowner means you can no longer call your landlord if an appliance breaks or your roof springs a leak. Pay close attention to the inspector and get a good sense of what things will cost in the future and how much life each appliance may have left. It’s best to set up a reserve account so that you have some money set aside when a major appliance breaks down or you need to replace the roof, siding, or other major household material.

#5 – Letting your emotions get the best of you.

Too many first-time homebuyers let their emotions get in the way of

logically purchasing a home. Yes, it can be very exciting to purchase a

home and set it up the way you really want it, but, don’t let those

emotions get in the way of logically buying the right home. Many

first-time buyers want to make their home their own too fast and end up

taking on more than they can handle. Buyers assume that a home improvement will pay for itself by increasing the home’s value but that’s not always the case. Buyers need to exhibit patience and make small changes over time to really build the home that they love.#6 – Let bills and loan payments lapse.

Just as with finance, credit and job change, you don’t want to make sure that you let any of your bills, especially loans and credit cards, fall behind on the payment. This again can negatively affect your interest rate and perhaps your loan program in general. Keep up with all of your bills, pay on time, and you’ll be glad you did when there are no hiccups or problems at closing.I want all of my buyers to be excited, happy and prepared when it comes to purchasing and owning a home. If you’re ready to get started please feel free to give me a call 951-259-0764

If you’re not sure where to start I would be happy to get you set

up with the lender in the area and offer tips and suggestions to get

started on the home buying process.

Friday, August 15, 2014

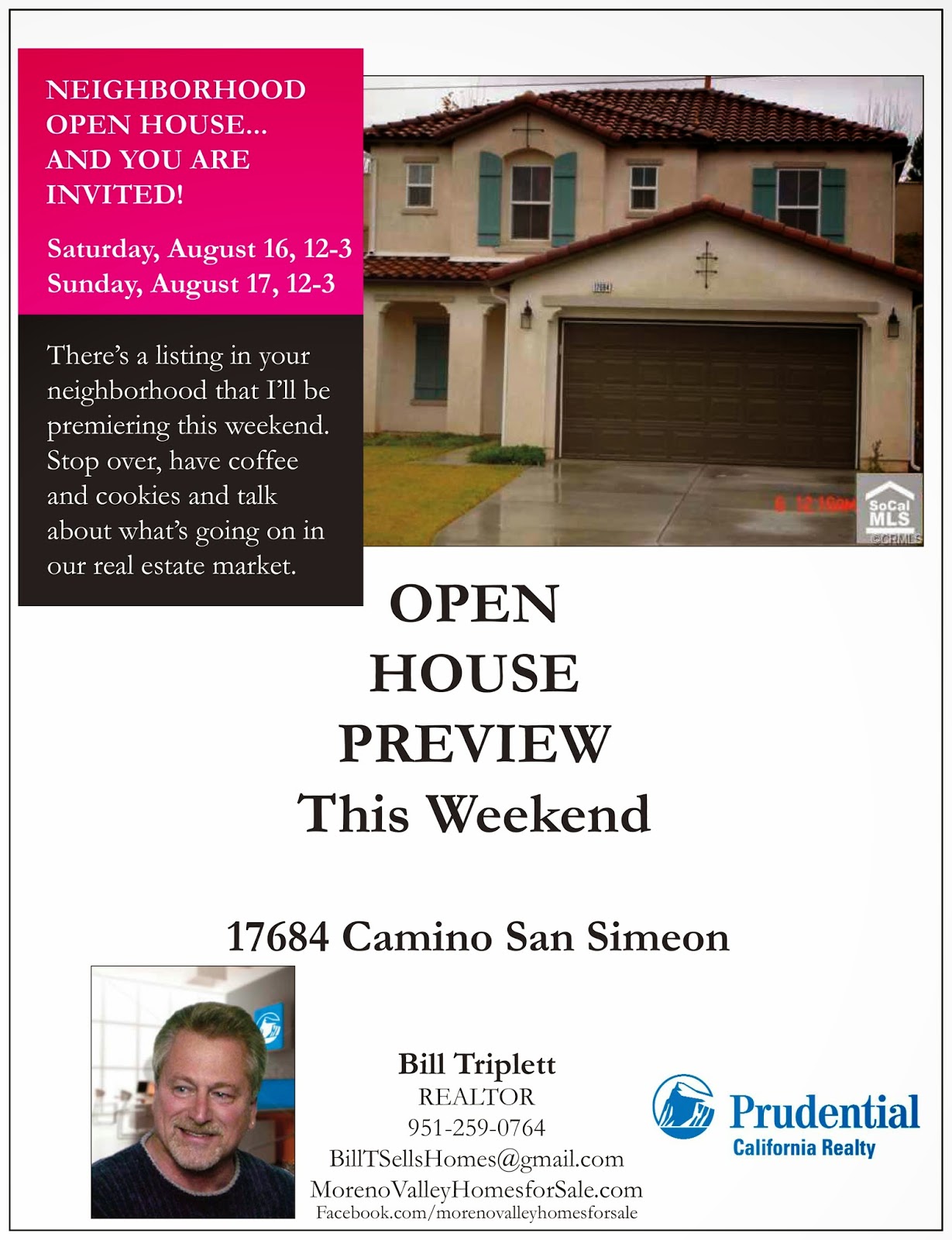

Preview Rancho Belago Home for the First Time

Would love to share this Premier Open House

with you this weekend. Great Rancho Belago location. It's available for

the first time to preview. Just stop by or call me at 951-259-0764. I'd love to share this beautiful home with you.

#homes #realestate #openhouse

#homes #realestate #openhouse

Subscribe to:

Posts (Atom)